First Merchant Bank is the first private sector commercial bank to be licensed in Malawi and opened to the public in 1995, with branches in Blantyre (also Head Office), Limbe, Lilongwe, (the capital), and Mzuzu. The bank was voted 'Bank of the Year- Malawi 2002, 2003, 2004 and 2005' by The Banker (a subsidiary of the Financial Times, UK). The FMB group also operates the country's leading Leasing and Finance Company and enjoys high growth with an expanding customer base across all sectors of the Malawi economy

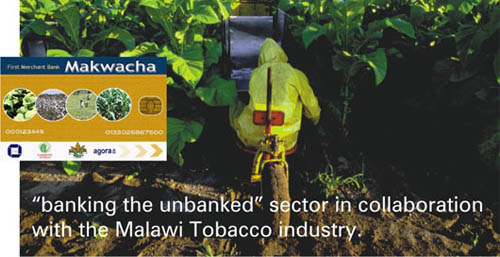

In an initiative to launch a differentiated financial product into the country, FMB deployed a unique approach to “banking the unbanked” sector in collaboration with the Malawi Tobacco industry. Tobacco is the leading cash crop in Malawi and the largest contributor to the much needed foreign exchange in this poor country. To tap into the treasury income generated from tobacco sales, the bank implemented the TranZact solution under a turn-key project to launch a co-branded card in partnership with TAMA - Tobacco Association of Malawi, a leading tobacco grower's co-operative and Farmers World Limited (FWL) & Agora, merchants with a country-wide network of stores that served the farmer community with agricultural supplies, chemicals, tools while also serving as a community convenience store. By implementing a path-breaking business model, FMB sought to deploy a multi-service payment product that delivered banking to the tobacco farmer with the convenience of a debit card that provided accessibility through a network of over 100 FWL merchant stores across the country. The TranZact project at FMB Malawi includes a network of In an initiative to launch a differentiated financial product into the country, FMB deployed a unique approach to “banking the unbanked” sector in collaboration with the Malawi Tobacco industry. Tobacco is the leading cash crop in Malawi and the largest contributor to the much needed foreign exchange in this poor country. To tap into the treasury income generated from tobacco sales, the bank implemented the TranZact solution under a turn-key project to launch a co-branded card in partnership with TAMA - Tobacco Association of Malawi, a leading tobacco grower's co-operative and Farmers World Limited (FWL) & Agora, merchants with a country-wide network of stores that served the farmer community with agricultural supplies, chemicals, tools while also serving as a community convenience store. By implementing a path-breaking business model, FMB sought to deploy a multi-service payment product that delivered banking to the tobacco farmer with the convenience of a debit card that provided accessibility through a network of over 100 FWL merchant stores across the country. The TranZact project at FMB Malawi includes a network of  10 ATMs and approximately 100 GSM PoS terminals situated at each FWL merchant store. The TranZact EFT switching application was interfaced to the Tobacco Auction systems, thus allowing instant credit of tobacco sales directly onto the tobacco farmer's bank and card account. The farmer only needs to access the nearest FWL store to swipe his card, enter his secret PIN and access his daily sales statement that provides him accurate information of his available credit. The farmer can either withdraw cash at the FWL merchant sore or use his debit card to make any purchases. Today 30,000 tobacco farmers in Malawi have access to multi-functional, convenient and affordable banking services through a revolutionary business model that harnesses collaboration between members outside the financial industry, enabling scale and lowering infrastructure costs. 10 ATMs and approximately 100 GSM PoS terminals situated at each FWL merchant store. The TranZact EFT switching application was interfaced to the Tobacco Auction systems, thus allowing instant credit of tobacco sales directly onto the tobacco farmer's bank and card account. The farmer only needs to access the nearest FWL store to swipe his card, enter his secret PIN and access his daily sales statement that provides him accurate information of his available credit. The farmer can either withdraw cash at the FWL merchant sore or use his debit card to make any purchases. Today 30,000 tobacco farmers in Malawi have access to multi-functional, convenient and affordable banking services through a revolutionary business model that harnesses collaboration between members outside the financial industry, enabling scale and lowering infrastructure costs.

The functionality of the FMB TranZact project will include a range of yet un-offered services to the citizens of Malawi. Makwacha cardholders additionally get an SMS statement that informs them of the sale proceeds at the auction floors, through the TranZact functionality.

The TranZact project included the implementation of our EFT switch, setup their card production centre, operations departments as well as the deployment of a network of in-branch ATMs and a mixed network of GSM and Landline POS terminals across the country. The project also included the initial production of the Makwacha cards, PIN Mailers and ATM receipt rolls.

Malawi's tobacco industry is a prime contributor to the government's foreign exchange requirements and is a key source of income to over 100,000 farmers country-wide. |