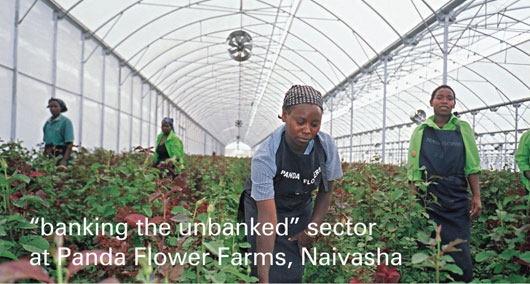

Panda Flowers like all farms in East Africa followed the traditional process of payroll dispensing, which involved huge risks with transporting large amounts in cash and problems with distributing meager amounts to large numbers, weekly. The TranZact project changed the industry and became CFC's unique service offering for its corporate customers involved in farming.

Africa's first farm payroll project at Panda Flowers today offers thousands of their farm workers access to their salary all through the month, through their own secure, personalized payroll cards from onsite ATMs driven through the TranZact FT switch. The cash withdrawal transactions, up to the limit of the farmworkers monthly salary are logged on the TranZact Oracle database without overloading the bank's core banking system. The salary is electronically uploaded into the Switch every month and a single entry into the core banking system GL is passed at pre-set intervals.

The payroll-processing project is revolutionary at various levels, chiefly the penetration of banking services to the untouched segment of the populace, especially in an agro driven economy. It is a socio economic transformation that puts CFC on the map as a bank of the people, offering under-privileged workers reduced risks of robbery, abuse of women, loss, more money management and breaking a mistaken belief that banks and ATMS are meant for the exclusive few. Rightly so as CFC's new service is being adopted by more and more farms in the region.

In what was mistaken a saturated sector, TranZact explored new avenues for growth. Our 'banking the un-banked' project is a larger than life example of the same.

The payroll card acts as the foundation for additional services in future loans, mobile recharge, money transfer and also provides a great status value.

Most banks were competing in the same markets with similar products, realizing this we decided to explore various strategies which snow balled in to the first ever payroll-processing project. The project at Panda Flowers, Naivasha, Kenya, is the first of its kind in the history of Africa.

CFC has recently replicated this product offering to numerous farms in Kenya and has now taken their services to other corporate sectors. CFC has recently replicated this product offering to numerous farms in Kenya and has now taken their services to other corporate sectors.

The Kenya Floriculture industry leads the world to control approximately 32% of the global flower industry! The Naivasha based farms are the 4th largest contributer of forex to the Kenyan government, in excess of 250m$.

Components and capabilities

TranZact was developed exclusively for the needs of banking the underbanked, by fundamentally aiding financial institutions deliver reasonably profitable products, at extremely low costs in an extremely affordable manner. It has been proven in diverse markets and across various emerging market sectors, from farm workers to mine workers and to deliver financial as well as government services. The components of TranZact include:

- An industry standard EFT Switch application that runs off an Oracle database and Tuxedo Middleware

- The Application and database server that runs of any Open Unix system Server viz. Linux, Solaris, HPUX, AIX.

- An HSM for managing PIN and Card cryptography

- A Card printer to produce mag-stripe cards

- Printer and UPS accessories

- A point-of-sale (POS), GSM or PSTN device with:

– A hybrid (smart & Magnetic stripe) card reader to authentic client and

third parties;

– A numeric key pad to select a service application and aiding transaction requests;

– An inbuilt thermal printer to provide paper receipts to the client and third party as proof of the transaction;

– A battery power unit for use with intermittent power sources.

- Alternatively an ATM/Cash dispenser.

- The built-in capability to connect through the cellular (GSM) infrastructure

- An electronic client identity system viz. magnetic stripe cards with online PIN authentication.

The solution uses GSM, GPRS, PSTN or VSAT communication channels to allow the POS & ATM devices to link into the back-end EFT TranZact Switch server which is further interfaced into the country's national funds clearing system or a primary financial institution's core banking systems. This ensures account balances are up-to-date online and reconciled instantaneously at the server's database and provides an electronic interface for the bank to use in debiting or crediting the client's account.

Benefits

TranZact securely captures disbursement and payments of payroll, commodity sales, loans, and savings data electronically, storing and transmitting information that is currently tracked manually. It also facilitates the creation of an electronic identification system for financial institutions and other participating stakeholders.

Capabilities

TranZact allows cardholders to perform additional transactions, such as transfer funds from savings accounts to loan accounts and look up account balances. TranZact also allows users to procure airtime re-charge, pay utility and other bills and even send funds to other individuals.

To learn more

For further information on the Technology Association Payments System, visit http://www.mtranzact.com |